While it’s well worth reaching out to all leavers, it’s the voluntary ones you need to worry about, because they also have the potential to become active detractors. Maybe a B2B buyer’s company was acquired and no longer needs your service, or a consumer may have had a change in lifestyle that made your product unnecessary. These are a number of reasons customers opt out some are voluntary, some are passive or involuntary. What Causes Customer Attrition? Why Do Customers Leave?

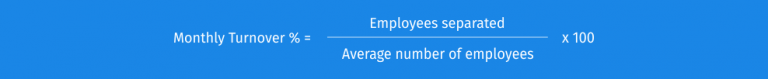

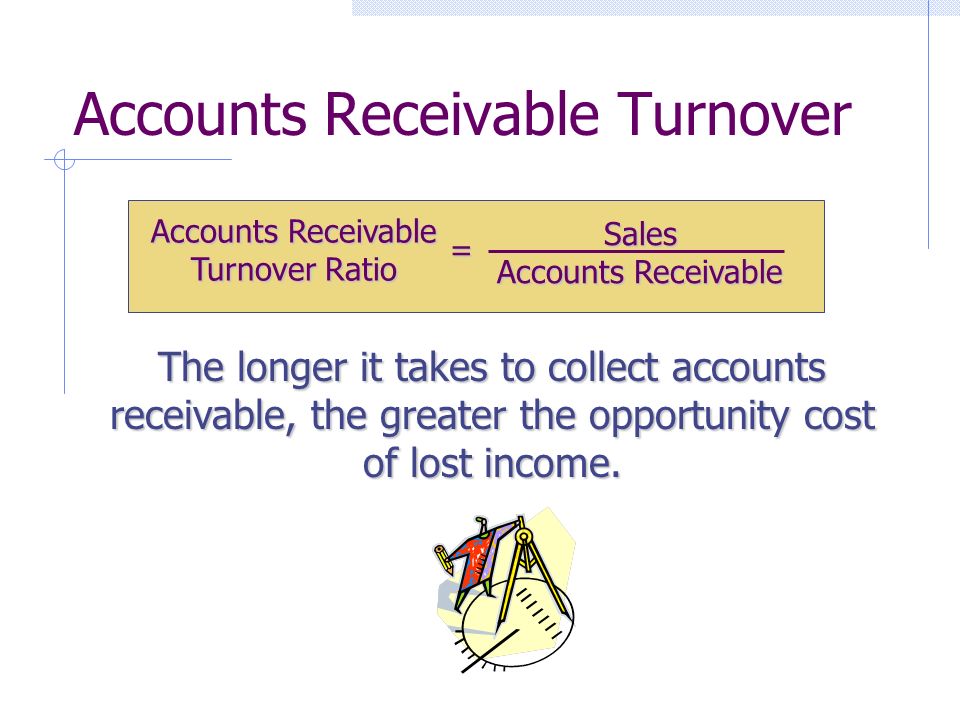

A high churn rate means you’re a hamster on a very expensive wheel. That is, the amount a customer spends must equal over time the amount you spend to acquire a customer, or else you’re losing money on each customer. TOTAL SALES & MARKETING COSTS / NEW CUSTOMERS = CACĬhurn rate is important because for every customer you acquired then lost, that spending needs to happen over again just to keep buyer numbers level. Once you have both numbers, use this formula: If you believe there is a lagging relationship between marketing efforts and new customers, you may want to factor in a specific attribution window like one week or one month. Then, see how many new customers or subscribers you gained during that time span. Here’s a back-of-the-envelope way to calculate your cost to acquire a new customer: But don’t take the analysts’ word for it. It’s conventional wisdom that acquiring a new customer is significantly more expensive than retaining and growing an existing customer. It makes sense to use every available tool to not only retain buyers but to predict when they might want to buy even more of what you’re selling in other words, to make them loyal customers. You spend a lot of money and effort finding prospects and convincing them to try your goods or services. The analogy is a hamster on a wheel-without retention, you won’t get anywhere. Retention rates reveal how many customers renewed their subscriptions or continued to purchase products over a specified time period attrition rates help understand how many opted out of your products or services.Ī high churn rate limits the rate at which a company can grow, because it means it must continually spend to acquire new customers. If we take 20% as an average, companies are losing one of every five customers they worked so hard to acquire. cable companies experienced the highest rate of churn, at 28%, followed closely by retail at 27% and financial firms at 25%. In the case of a recurring revenue or subscription business model, that competitive offerings have higher appeal, or that your customer service is sub-par, for example. It could mean, in the example above, that your products have only temporary value. It’s a critical KPI that all businesses should track. What Is Customer Churn or Customer Attrition?Ĭhurn, or attrition, is the rate at which customers stop purchasing your products or services measured across a specific time period.

In this article, we’ll share lessons and advice relevant to companies across industries. It can help organizations understand a particularly relevant form of ROI, or return on investment-return on customer acquisition investment (ROCAI). Monitoring customer attrition is a best practice for any business. Without this information, it’s difficult to know whether your offerings are meeting customer needs. Strong customer retention requires not only knowing how many buyers are leaving but why, what it costs to replace them and calculating the odds that you could get them back with some targeted outreach. That’s customer attrition, and it’s costly. Say you spend $100 on marketing to convert a prospect into a buyer, who then purchases $50 in goods or services but never returns. East, Nordics and Other Regions (opens in new tab)

0 kommentar(er)

0 kommentar(er)